As the world continues to rely on oil and gas as major sources of energy, investors seeking opportunities in the energy sector may consider oil and gas stocks as potential investments. Despite the increasing focus on renewable energy, the demand for oil and gas remains significant, making these stocks attractive for investors looking for potential growth and profitability.

Here are three “Strong Buy” oil/gas stocks from Wall Street –

Devon Energy Corporation – SYM: DVN

Recent Price: $46.08

Price Target: $56.28

Firms with Buy Rating: Morgan Stanley, Goldman Sachs, Piper Sandler

Description: Devon Energy Corporation, an independent energy company, explores for, develops, and produces oil, natural gas, and natural gas liquids in the United States. It operates in Delaware, Anadarko, Williston, Eagle Ford, and Powder River Basin. The company was incorporated in 1971 and is headquartered in Oklahoma City, Oklahoma.

===

The No. 1 AI Stock of 2023 (Not Nvidia)

It’s not Nvidia, Meta Platforms, Alphabet, or Amazon. But thanks to a recent major deal, an under-the-radar stock could become the No. 1 winner of the 2023 AI boom. “This company just teamed up with one of the biggest power players in the AI industry… yet you can still buy it for just one-twelfth the price of Nvidia – the time to buy is NOW,” says Marc Chaikin.

Click here for the name and ticker.

===

Diamondback Energy, Inc. – SYM: FANG

Recent Price: $158.51

Price Target: $184.16

Firms with Buy Rating: Piper Sandler, UBS, J.P. Morgan

Description: Diamondback Energy, Inc., an independent oil and natural gas company, focuses on the acquisition, development, exploration, and exploitation of unconventional and onshore oil and natural gas reserves in the Permian Basin in West Texas. It focuses on the development of the Spraberry and Wolfcamp formations of the Midland basin; and the Wolfcamp and Bone Spring formations of the Delaware basin, which are part of the Permian Basin in West Texas and New Mexico. The company also owns, operates, develops, and acquires midstream infrastructure assets, including 770 miles of crude oil gathering pipelines, natural gas gathering pipelines, and an integrated water system in the Midland and Delaware Basins of the Permian Basin. Diamondback Energy, Inc. was founded in 2007 and is headquartered in Midland, Texas.

===

Something Stinks on Wall Street—20 Stocks to Sell Today

20 Most Hated Stocks on Wall Street. Wall Street analysts are issuing rare downgrades and sell ratings for these stocks. Are any of these stocks in your portfolio?

Click here to find out. FREE

===

Occidental Petroleum Corporation – SYM: OXY

Recent Price: $60.63

Price Target: $69.13

Firms with Buy Rating: Raymond James, TD Cowen, Morgan Stanley

Description: Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, North Africa, and Latin America. It operates through three segments: Oil and Gas, Chemical, and Midstream and Marketing. The company’s Oil and Gas segment explores for, develops, and produces oil and condensate, natural gas liquids (NGLs), and natural gas. Its Chemical segment manufactures and markets basic chemicals, including chlorine, caustic soda, chlorinated organics, potassium chemicals, ethylene dichloride, chlorinated isocyanurates, sodium silicates, and calcium chloride; and vinyls comprising vinyl chloride monomer, polyvinyl chloride, and ethylene. The Midstream and Marketing segment gathers, processes, transports, stores, purchases, and markets oil, condensate, NGLs, natural gas, carbon dioxide, and power. This segment also trades around its assets consisting of transportation and storage capacity; and invests in entities. Occidental Petroleum Corporation was founded in 1920 and is headquartered in Houston, Texas.

===

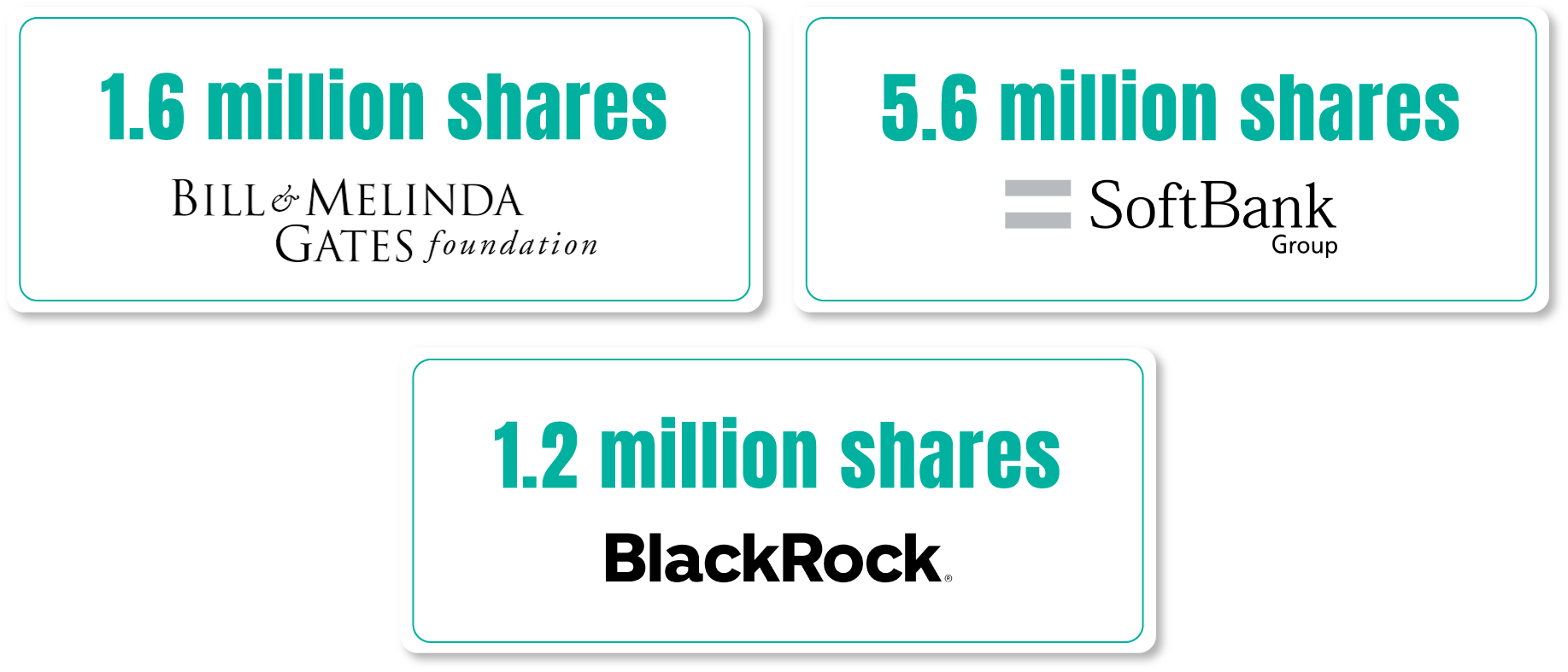

Biggest Investors in the World LOADING UP on This AI Stock

It’s a small cap that trades for less than $10… Yet the biggest investors in the world own millions of shares.

Why? Because their AI just did something no company has ever done before.

Details here.